Japanese Equities

Overview

- Genuine changes to corporate governance among Japanese firms are starting to take hold.

- These changes may lead to firms not only generating sustainably higher returns, but also being rewarded for those higher returns with higher valuations.

- Our bet on improving Japanese corporate profitability is a multi-year theme rooted in micro-foundations – the changing interaction between managers and shareholders.

Lessons from history

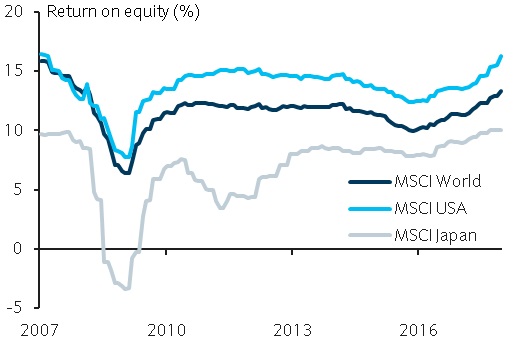

Japanese corporate profitability trends at a lower level than much of the rest of the developed world, particularly the US (Figure 1).

The history of corporate Japan, both pre and post-WW2 is more influential in this story than many realise. Japanese chief executives and owners have long focused on stability and market share over the traditional American model, where maximum profitability is the first, and in some eyes, the only responsibility of management.

From heavy clustering of AGM’s (making shareholder challenge more difficult) to a high degree of cross shareholdings (creating a base of eternally friendly shareholders and contributing to inefficient allocation of capital), inferior Japanese corporate governance in Japan can explain a large proportion of the shortfall in trend profitability.

Is the change real this time?

These long acknowledged hindrances to a higher trend in corporate profitability have proved harder to shift than the analyst community have repeatedly argued down the years. However, genuine changes are starting to take hold, and are being rewarded by investors. AGM clustering is declining fast while independent directors are multiplying.

Beyond that, there are now increasing signs that following the new corporate governance code, the stickiest of these inefficient practices, cross-shareholdings, are starting to decline. The recently implemented revised corporate governance code in principle rejects the practice of cross-shareholdings and calls for companies to comply with this principle.

We have already seen a marked uptick in reduction policies announced in the reports issued between June and August of this year, just after the implementation of the new corporate governance code. We would expect this to accelerate as the code becomes embedded.

So what?

Superficially, it is hard to see why these changes in corporate governance would set investor pulses racing. However, for long suffering investors in Japanese equities, these changes if they continue to take hold could represent the beginning of a genuine regime change for investors. One which ends with Japanese companies not only generating sustainably higher returns, but also being rewarded for those higher returns with higher valuations.

This is something that investors will want some exposure to in portfolios if it does indeed proceed as we are starting to believe.

Alongside this, we think that a Japanese economy currently emerging from more than two decades of deflation may provide a helpful tailwind to corporate profitability (Figure 2).

The combination of rising inflationary pressure and a relatively tight labour market implies more upside to wage gains, which should in turn encourage more capex investment among Japanese companies in order to reduce labour costs. The productivity gains from increased capex spend would be complementary to the above-mentioned benefits from improved corporate governance. Not only would these productivity gains translate into greater profitability, better corporate governance would make it more likely that capex investment funds will be spent efficiently (i.e. targeting projects or acquisitions that maximise shareholder value, as opposed to managerial ‘empire building’).

However, we also note that our bet on improving Japanese corporate profitability is a multi-year theme rooted in micro-foundations – the changing interaction between managers and shareholders – rather than the path of the domestic economy. Therefore, we think it’s less dependent on us having to undergo the difficult task of forecasting the multi-year path of the Japanese economy.