European Banks

Overview

- The European economy continues to provide a helpful backdrop for the region’s banks

- Valuations are not demanding, providing room for re-rating

- Regulatory and other risks remain, but upside potential remains significant.

Value or value trap?

While the banking sector on the other side of the pond has soared over the past few years, value investors have kept a keen eye on the continental European banking sector as their shares have suffered. Structural challenges vary across countries within continental Europe but failure to adapt business models, non-performing loans and negative interest rates are just some of the common factors which have weighed on banks’ profitability.

The recent soggy patch in the continental European economy can be largely chalked up to the transitory effect of a messy adoption of new auto emissions tests. This will fade as we look at the 12 months ahead and the fundamental outlook for European banks is likely to improve, in our opinion.

Cyclical tailwinds

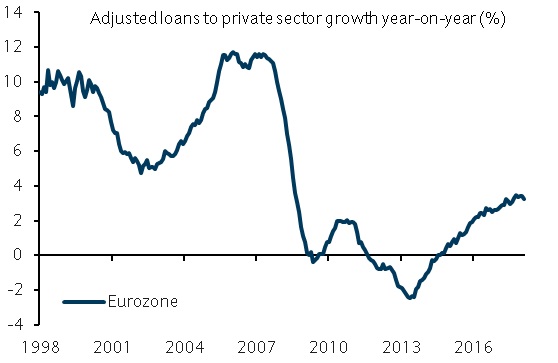

With structural challenges likely to be resolved only slowly, we are more reliant on Europe’s cyclical upturn to help drive bank profitability higher. Despite the recent slowdown, we continue to see an increased demand across corporate lending, mortgages and consumer credit. A robust macro backdrop should continue acting as a tailwind for loan growth – a key driver of bank profitability (Figure 1).

The ECB’s reluctance to raise interest rates has put pressure on net interest margins, but with the central bank set to hike rates in 2019 this headwind could fade. Meanwhile, banks’ capital positions have significantly improved in recent years, with the European sector’s core regulatory capital as a proportion of total risk-weighted assets having doubled in the last decade. On balance, European banks have been moving in the right direction, and their fundamental position has improved markedly compared to the last several years.

Take out

Investors will not need long memories to work out why this is not an investment for all risk appetites. Notwithstanding the aforementioned hurdles, the sector remains hostage to European political uncertainty, with the most recent example being Italian politics, which seemed to draw attention away from a marginally improving picture of underlying fundamentals.

Meanwhile, risks of rising trade protectionism threaten to derail growth momentum, and the cyclical tailwinds for bank profitability with it. Turkey’s currency crisis also weighed on sentiment at the end of the year, given fears regarding some of the bank’s exposure to Turkish assets. However, the exposures are estimated to be minimal which has alleviated fears of any systemic solvency risk to the wider sector.

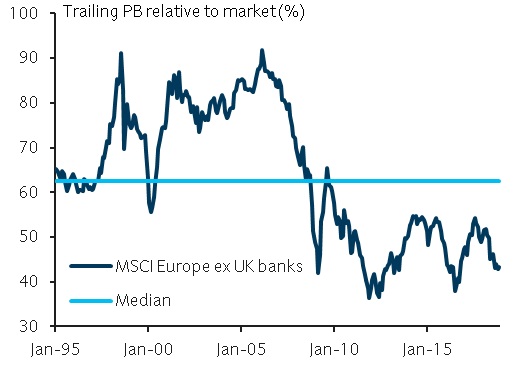

Valuations are currently low relative to history (Figure 2), thus implying higher upside potential should our base scenario play out as expected. All in all, the sector remains an attractively priced, albeit risky, long-term play on European growth. Nerves of steel and patience are still required, but still likely to be rewarded in our view.