Emerging Asia

Overview

- Emerging (EM) Asia is a leveraged bet on global growth due to its highly cyclical composition

- Whilst unhelpful, the world economy can likely digest a further trade escalation

- Investor sentiment is excessively weak as leading indicators point towards robust growth.

Desynchronising Growth

After reaping the benefits of synchronised global growth in 2017, EM equities have stumbled since amidst slower than expected growth, higher US rates and increased risks surrounding trade protectionism. The improving economic backdrop for the region appears to have paused, temporarily in our view. Recent economic data for the smaller open economies like Korea and Taiwan – who last year were beneficiaries of the region’s export-led growth recovery – have shown early signs of slowing momentum, but still remain positive for now.

Trade truce

The ongoing tit-for-tat tariff announcements between the US and China has dominated headlines and commentaries alike over recent months. It is probably wise to have muted expectations for any sort of lasting agreement here. Although, a US administration deprived of its ability to dictate the legislative agenda by the midterm elections may need to strike a more conciliatory posture on trade to help stave off darker economic times ahead of the 2020 Presidential election.

The likely point for investors here is, despite of course being unhelpful, the world economy can likely digest a further escalation in trade tensions and the associated tariffs. At the same time, Chinese policymakers are currently in a difficult balancing act – attempting to reduce leverage in the economy and curb financial stability risks one on hand, whilst trying to stimulate economic growth and restore market confidence on the other. So far they’ve demonstrated sufficient control in the policy levers they have available, which has led to a gradual slowdown rather than anything more sinister.

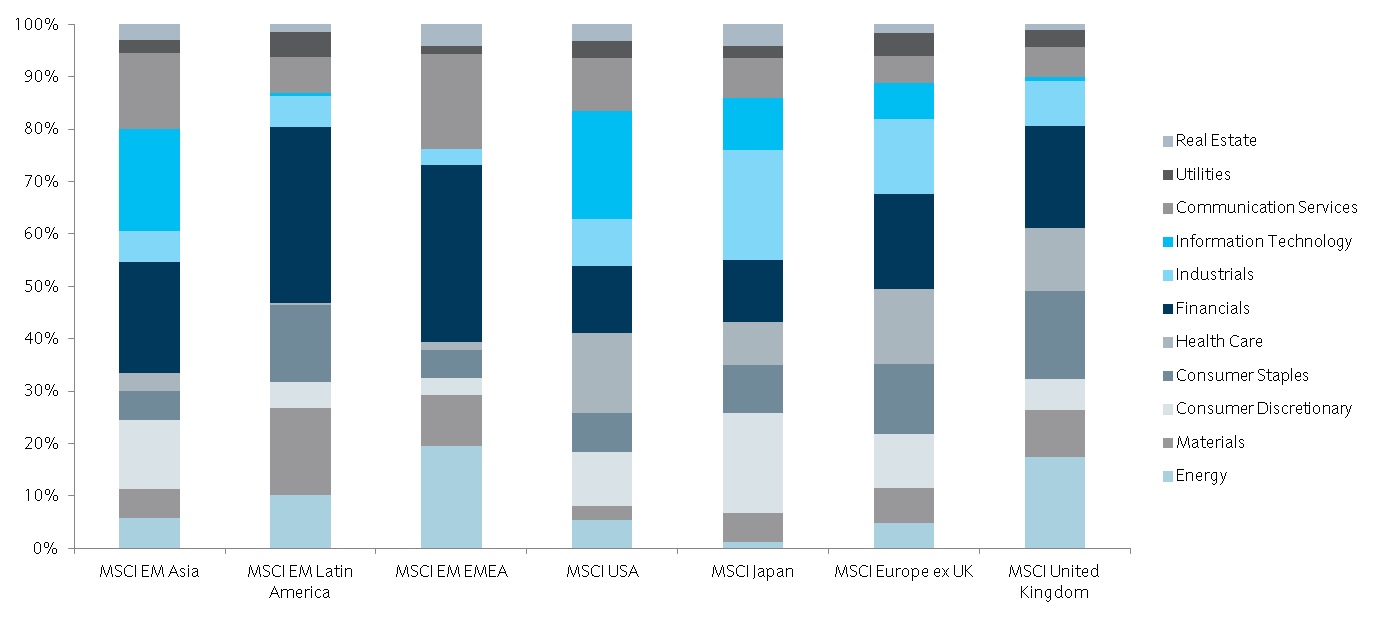

Cyclical sector composition

Growth expectations have moderated, but leading indicators continue to point to a healthy economic backdrop. In our view, investor sentiment has become excessively weak towards a region which comprises of a large proportion of (non-commodity) pro-cyclical sectors levered to the global growth cycle. Unlike EM Latin America (which is heavily exposed to unpredictable movements in commodity prices), or EM EMEA (which has a less cyclical composition), the EM Asia index boasts more than 65% of its constituents in the more desirable sectors such as technology, financials, and industrials (Figure 1).