Blue Chips

Overview

- Persistently low inflation post-Crisis may have caused investor complacency over inflation risks

- Stocks which exhibit pricing power can provide a degree of protection to risks of inflation

- Brand image and market position are helpful determinants of a company’s pricing power.

The outlook for inflation

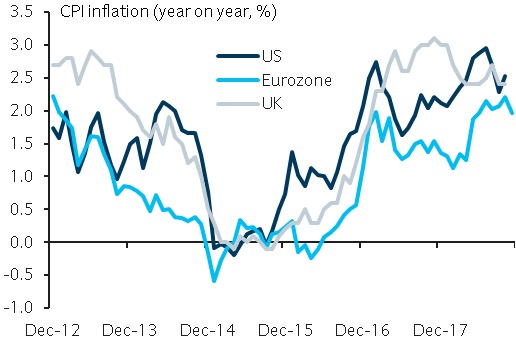

Post-Crisis inflation has been persistently low across geographies. As central banks have fallen short of their inflation targets for a number of years, inflation expectations have gradually been drifting lower. However, the unemployment rate in the US remains at historically low levels with few signs of easing. Absent a material deviation from its target, we still expect monetary policy to be normalised gradually and for bond and stock markets alike to be able to digest this.

However, there are certainly less investor-friendly scenarios; with incoming inflation data closer to central bank targets and wages starting to show signs of the increasingly scarce supply of willing workers, are investors becoming complacent with the risk of an inflation overshoot?

Hedging against inflation

Combatting inflation risk can be tricky – there is no single investment that serves as a perfect hedge in all periods of inflation. However, stocks with pricing power can provide some measure of protection in the context of a balanced portfolio. Portfolios currently consisting solely of the higher quality corners of the fixed income complex or cash will still be struggling to make a positive real return.

For example, the UK 10-year nominal gilt yield is currently around 1.25% and UK CPI inflation, which has eased from its peak, remained at 2.4% for November (Figure 1), meaning that the holder is losing over 1% in real terms per annum.

Our research indicates that during periods of high inflation, equities typically outperform bonds, with the latter offering investors a negative real return – particularly during periods of exceptionally high inflation like we saw in the late 1970s and early 1980s.

Pricing power

Investors concerned about the prospect of inflation should consider tilting their equity exposure towards companies with strong business models and pricing power that are able to pass higher input costs on to their customers. We believe stocks with these characteristics are well positioned to outperform the overall stock market during inflationary periods.

The main determinants of pricing power, in our view, are a firm’s brand image and market position. Certain companies have built up considerable brand loyalty over time and are therefore more likely to be able to raise prices without losing business to competitors. Luxury goods companies are another prime example of this.

Likewise, companies that are technology leaders in their respective fields have the capability to raise prices if conditions dictate. Competitors find it very hard to replicate their products and so these firms are in a powerful strategic position. In such a context, investors are best served by owning a basket of liquid, blue-chip stocks with these characteristics, diversified across different sectors and regions.