Fixed Income

The balance is shifting

10 September 2024

Michel Vernier, CFA, London UK, Head of Fixed Income Strategy

Please note: This article is more technical in nature than our typical articles, and may require some background knowledge and experience in investing to understand the themes that we explore below.

All data referenced in this article are sourced from Bloomberg unless otherwise stated, and is accurate at the time of publishing.

Key points

- Up until this summer the bond market was focussed on inflation. But after weaker-than-expected job market data, the narrative seems to have shifted. In addition, the Fed has recently emphasised growth risks

- The jobs market seems to be distorted by post-pandemic dynamics, and early signs of cooling within the job market does not necessarily imply a derailing US economy. In choosing when to cut rates, the Fed is likely to consider a broad set of factors, including consumer sentiment, which seems to remain healthy

- Some retracement (bounce in yields) after the sharp retreat of late seems a possibility in the shorter term. But, over the medium term the broad direction appears to be that of somewhat lower trending yields, which justifies a constructive stance over bonds

- Either way, while the window for locking in yields is still open, it may close soon

The rate market has materially re-priced over the summer. Back in June, the US 10-year yield was closer to 4.5%, compared to just 3.85% today. The downward move was driven by a lower 2-year yield, which fell from almost 5% to 4%. The rate market, which so far has been led by concerns over delays in the moderation of inflation, has now clearly shifted its focus.

The importance of the labour market

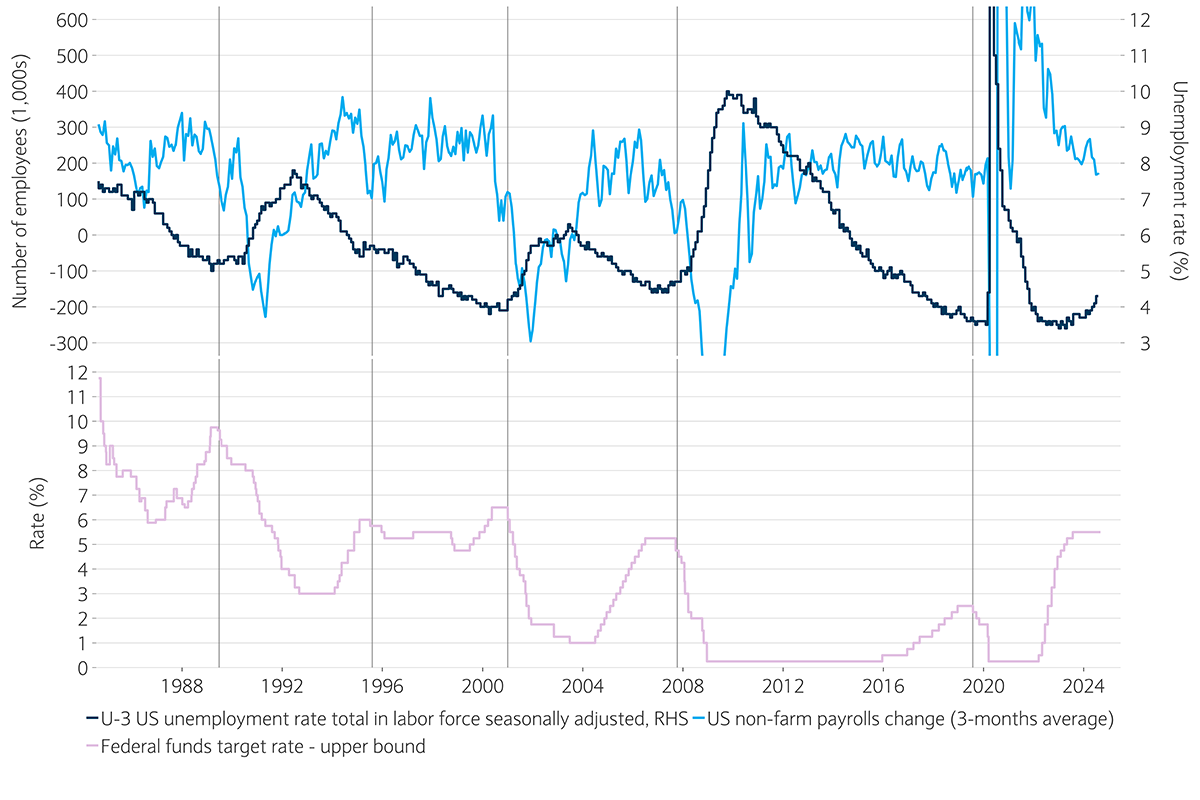

The closely watched payroll report was weaker for July, and combined with a rising unemployment rate, raised fears of an imminent US recession. The move was exacerbated by capital flows as a result of an unwind of yen carry trades. A rising unemployment rate reminded investors of the so-called ‘Sahm rule’ (named after US economist Claudia Sahm).

The framework effectively suggests that once the unemployment rate starts bottoming, visibly, the US economy is heading for, or is already in, the middle of a recession1. This relationship has been evident during the last eight cycles since 1970 (see chart). The latest rise, from 3.4% to 4.3%, would indicate a similar pattern, according to the rule. Also, the US Federal Reserve (Fed) argued that the “balance of risks has shifted” away from inflation and towards the second pillar of its mandate, the labour market.

The labour market and rate-cutting cycles

US unemployment rate trends a key factor in monetary policy

Sources: Bloomberg, Barclays Private Bank, August 2024

* Note - The vertical black line indicates the start of a Fed rate-cutting cycle.

The third phase of the cycle

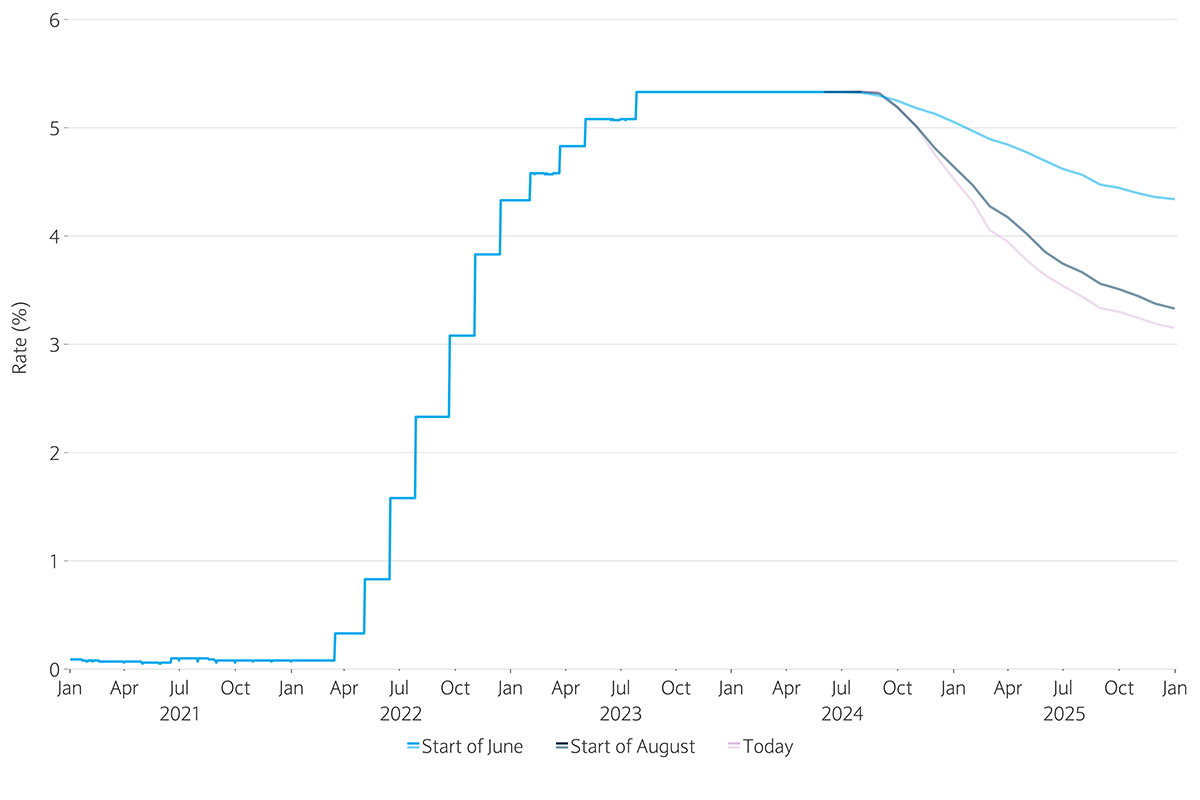

If one steps back, it seems that the policy-rate cycle has reached its third phase: after the debate evolved initially around the peak level of the policy rates in 2023, followed by the timing of the first cut in 2024, the question is now whether the cutting cycles will be shallow or deeper?

After the sharp repricing over the summer, the rate market now implies 100 basis points (bp) worth of Fed cuts by year-end, which would translate to a 50bp move in one of the remaining three rate-setting meetings, and a terminal rate in a range between 3% and 3.25% (a 200bp to 250bp cut from the peak), as shown in the chart.

Fed futures reprice lower

The rate market has repriced over the summer and now implies 100 basis points-worth of cuts by year-end

Sources: New York Federal Reserve, CME Group, Barclays Private Bank, August 2024

While this pricing does not imply a deep recession, it gives more weight to a recessionary scenario.

To put the current pricing into context: over the past 50 years, the Fed has cut rates by over 55% from the initial level, which applied to today’s 5.5% would translate to a terminal rate of 2.5%. (NB: During the last three cutting cycles the terminal rate was, in fact, only 10% of that seen before, on average, the period of ultra-low interest rates).

Don’t focus on one rule only

While a terminal rate of 2.5% or lower cannot be ruled out, such levels would reflect a recessionary environment. Indeed, in June’s Mid-Year Outlook, we concluded that in a recessionary scenario, “real policy rates of -1% to less than -1.5%, as seen in 2001 or 2008, appear to be plausible, which could translate to nominal policy rates of lower than 2%”.

However, a softening in the job market does not necessarily imply a deep recession. Our base case anticipates a cooling US economy, but not a deep contraction. Even Claudia Sahm suggested that especially in the post-pandemic world: “I would never just look at one rule”, and, “I do not think the U.S. economy is in a recession.2”

The consumer dictates the bond market

As mentioned at the Jackson Hole symposium in August, Fed chair Jerome Powell will be sensitive to a cooling job market, not least because it has implications for consumer spending which is a key pillar of the US economy.

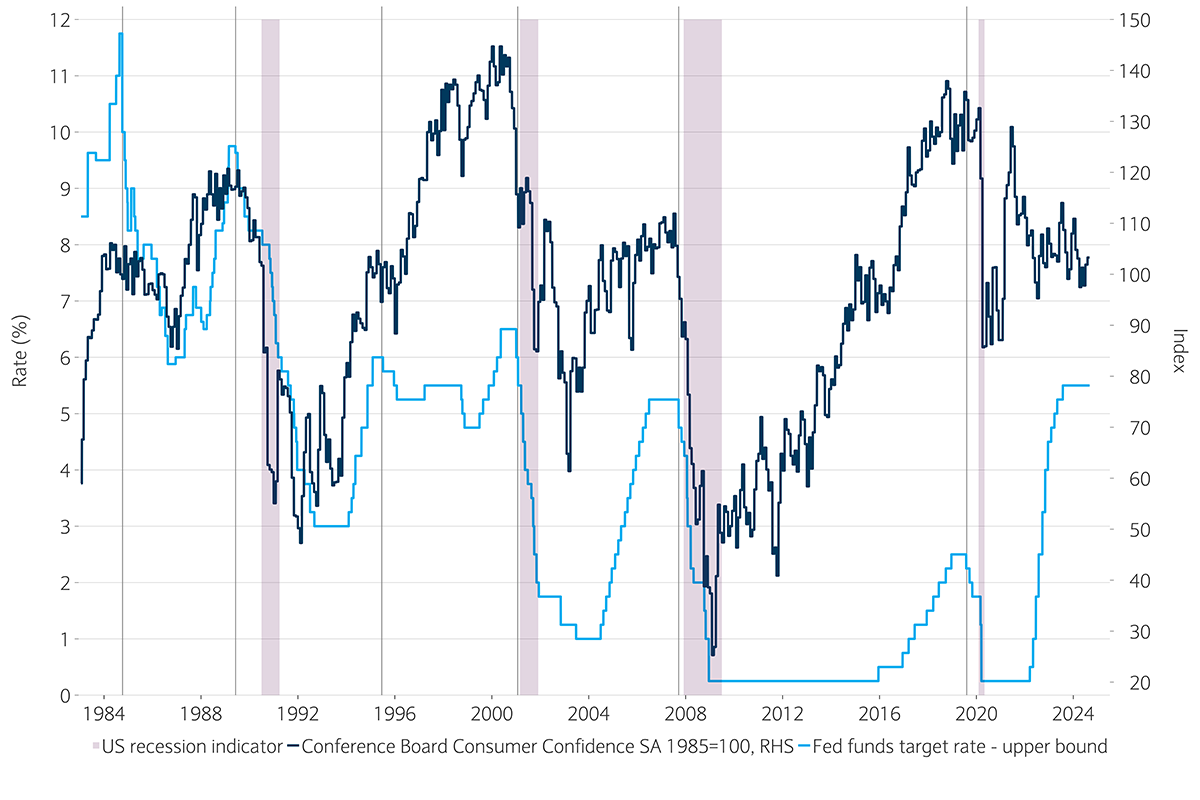

The National Bureau of Economic Research (NBER)’s ‘The economics of walking about and predicting US downturns’ paper, for example, explores this further. Published in October 2021, it illustrates that since 1980 recessions only occurred after a significant decline in consumer confidence, as measured by the University of Michigan or the Conference Board (see chart).

While the respective consumer survey measures have started to consolidate from elevated levels lately, they are far away from a deep contraction. Certainly, the Fed and the bond market will watch the dynamic of the consumer confidence in the coming month.

US consumer confidence and Fed policy rate

Sharp falls in consumer confidence have regularly been a recession warning

Sources: Bloomberg, Barclays Private Bank, August 2024

* Note - The vertical black line indicates the start of a Fed rate-cutting cycle.

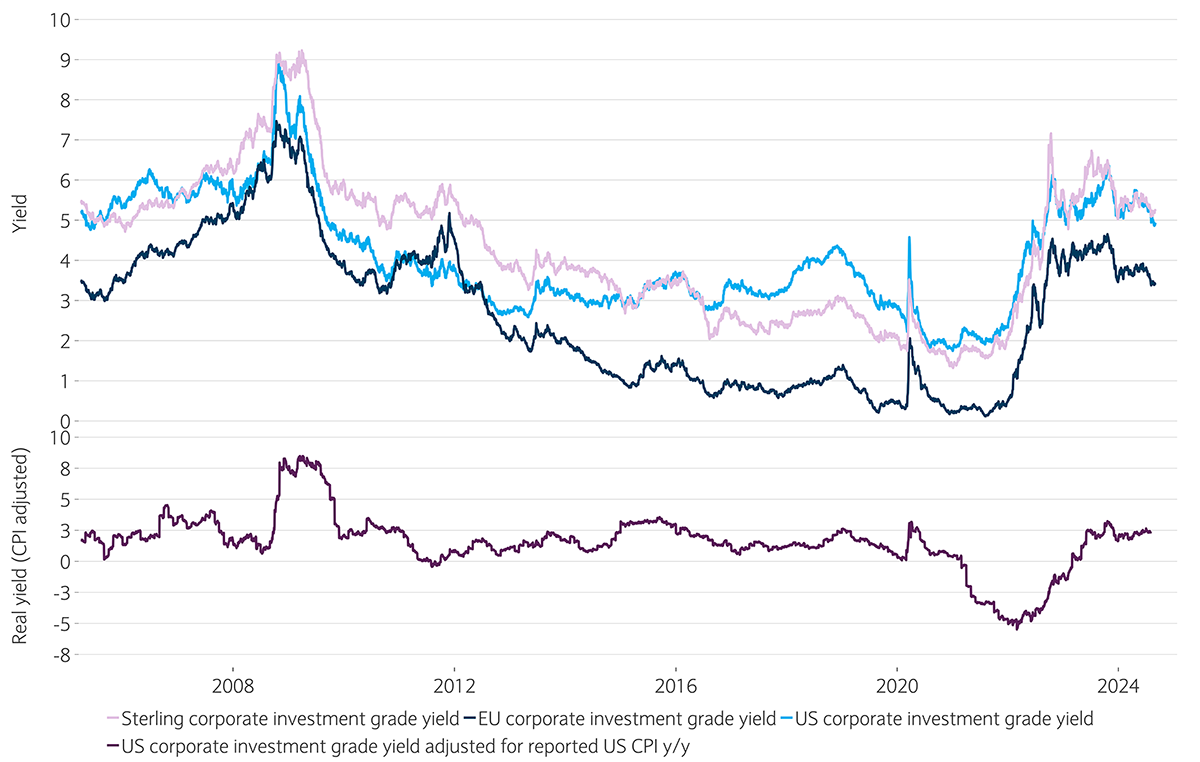

Bonds still carry value

The direction of travel for the US economy, and the response of the Fed, is a key focus for investors, given it builds the anchor for bond yields and fixed income returns, respectively. A 50bp move, as priced in, would imply a disorderly accommodation and in the absence of financial distress seems excessive. Consequently, a repricing that leads to somewhat higher yields seems likely in the shorter term. Over the medium term, the probability distribution seems skewed to more, rather than fewer, cuts in the long run.

As such, bonds still carry enough return potential, while peak bond yields, like those seen in the US or European investment grade markets, may have passed already. A higher probability of somewhat lower yields over the medium term would appear to justify a constructive stance over bonds, even after the recent decline.

The increased risk of a short-term retracement of yields (higher), in combination with the persistent fiscal uncertainty, and consequently the risk of higher debt supply, would seemingly point to taking a moderate duration stance overall.

With inflation at just above 2%, rather than well over 6%, and higher-grade debt bond yields delivering between 4% and 5%, real yields (adjusted for inflation) remain healthy (see chart). As the balance is shifting: the window for locking in yields with high-quality bonds may ultimately close.

Corporate bond yields and inflation adjusted yields

As the inflation rate normalises, investment grade bond yields offer healthy real yields

Source: Bloomberg, Barclays Private Bank, August 2024

Related articles

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.