Behavioural finance

Waiting for certainty on rates

09 October 2024

Alexander Joshi, London UK, Head of Behavioural Finance

Key points

- Some investors may have been waiting for the US Federal Reserve to cut rates in September, before investing in the markets again. However, trying to time the market can be a fools’ game.

- This tendency to wait for more clarity can be seen in the growth seen in US money market fund asset values, as well as flows, over the last two decades. While waiting on the sidelines can provide comfort, there are costs, such as foregone returns, as well as the possible real-term erosion of wealth from inflation.

- History shows that holding cash has been a losing proposition when compared against US equities. Indeed, since the last Fed hike in July 2023, cash has returned 7.0% while US equities returned over 4.5-times that.

- Those that look beyond the headlines and put and keep their money to work throughout the ups and downs of markets, and central bank rate moves, have been well-compensated for their actions.

The US Federal Reserve (Fed) cut its policy rate by a ‘jumbo’ half of one point in September, taking the target range to 4.75%-5.00% and down from a 23-year high. This was the first cut to borrowing costs since March 2020, at the start of the coronavirus pandemic.

Rates began to rise in 2022 to tackle inflation, which was initially expected to be ‘transitory’ and then became persistent, leading to a significant hiking of rates which have been held since 2023. A continuing concern for policymakers, and the market, has been the balance between growth and inflation.

A slowdown in US economic activity has been expected for some time. Indeed, a recession was widely expected in 2023, but did not materialise, even as growth slowed. The Fed has made it clear that it does not see any sign of recession on the horizon.

A turning point

Some investors may have been waiting for this rate cut to signal a turning point, a moment of some clarity around the path for policy rates. It can provide some reassurance about the world’s largest economy, and therefore anticipated US investment performance as well as that globally.

The S&P 500 and the Dow Jones closed at record highs in the trading session following the cut, boosted by a charge in tech stocks. Some may have been waiting on the Fed to act in order to get back in the tech growth trade, a source of much of the momentum seen in stock indexes this year.

Comfort in waiting

With interest rates at significantly elevated levels versus recent history across the globe, and (warranted) concerns about economic growth prospects, some investors have questioned the case for being invested over the last couple of years. After all, why take risk in an uncertain environment in the face of a compelling risk-free rate of return? Surely, the strategy of capitalising on that window and then taking higher risk exposure when the situation reverses would be more optimal.

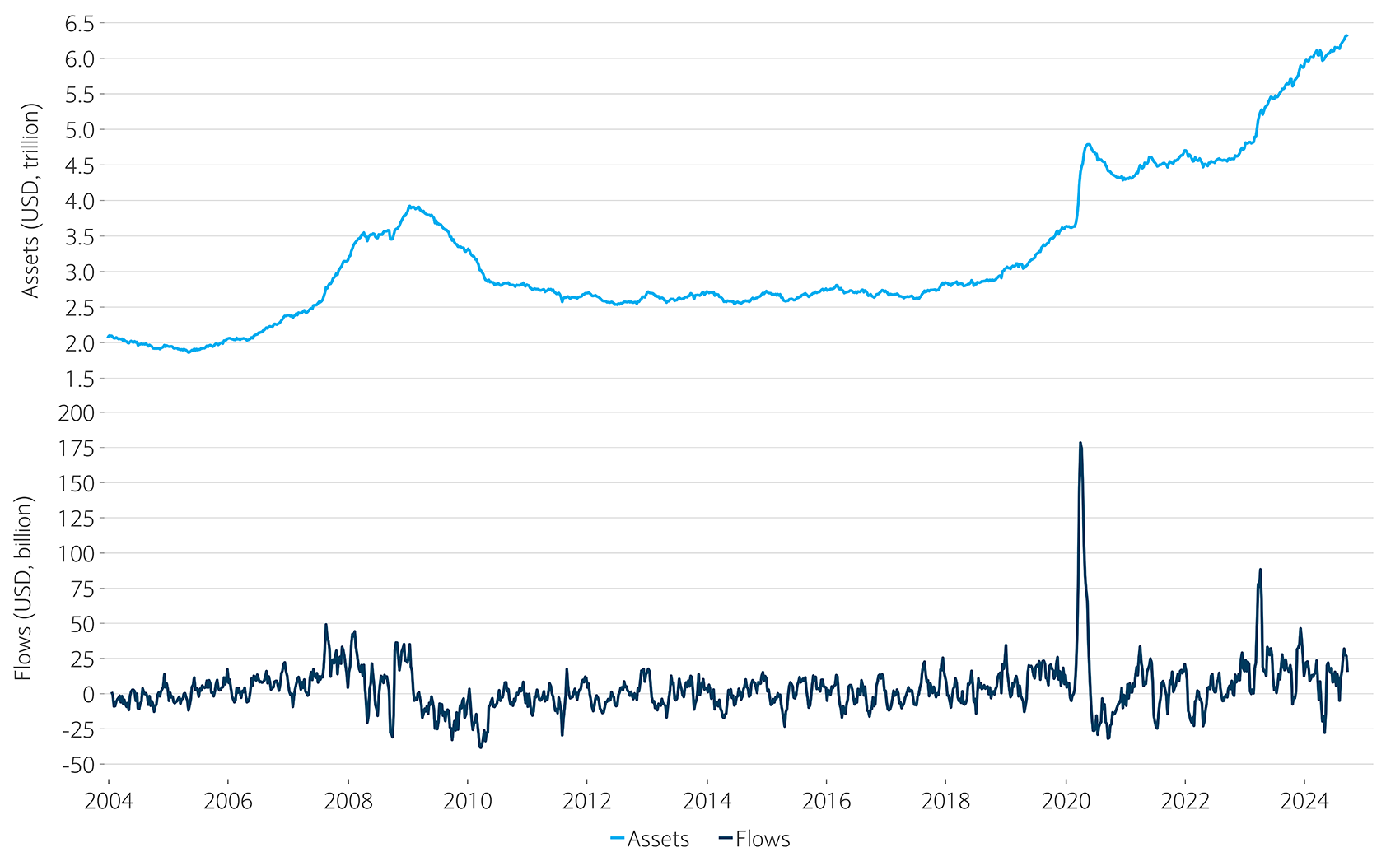

This tendency to wait for more clarity can be seen in the growth seen in US money market fund asset values, as well as flows, over the last two decades (see chart).

Waiting for more clarity

The asset and money market flows seen in US markets in the last two decades

Sources: ICI, Barclays Private Bank, September 2024

Many investors want to wait for the optimal entry point before gaining investment exposure. However, timing the markets is difficult without the benefit of hindsight. Strong market performance in the interim can make it difficult to get in to the market, and investors can find themselves holding cash for far longer, and costlier, period than they originally anticipated.

As discussed in the past, due to the forward-looking nature of markets, many of the events that investors think about waiting for, before taking investment decisions, are already largely factored into the price.

But comfort has costs

While waiting on the sidelines can provide comfort, there are costs, such as the opportunity cost of foregone returns, as well as the possible real-term erosion of wealth from inflation.

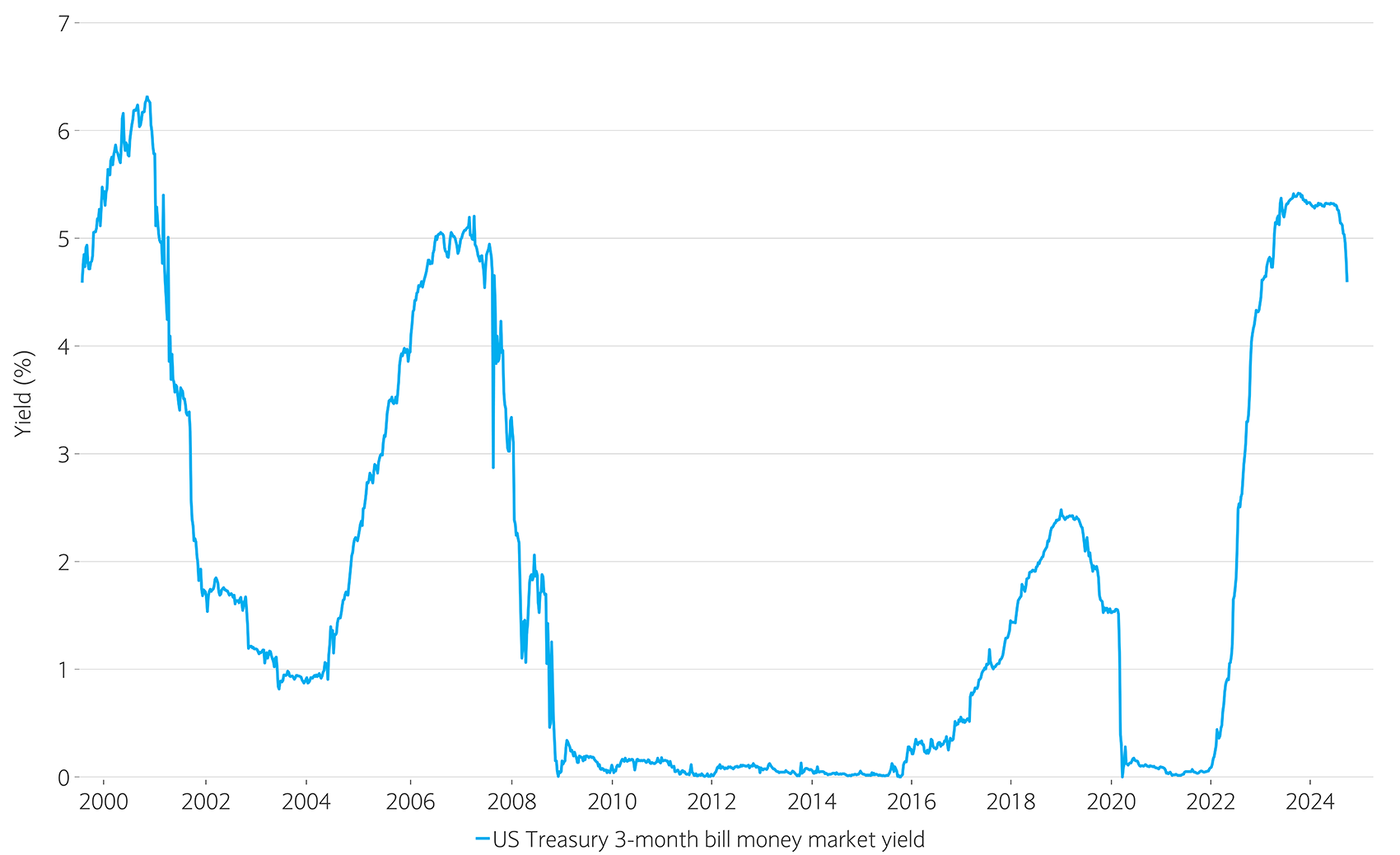

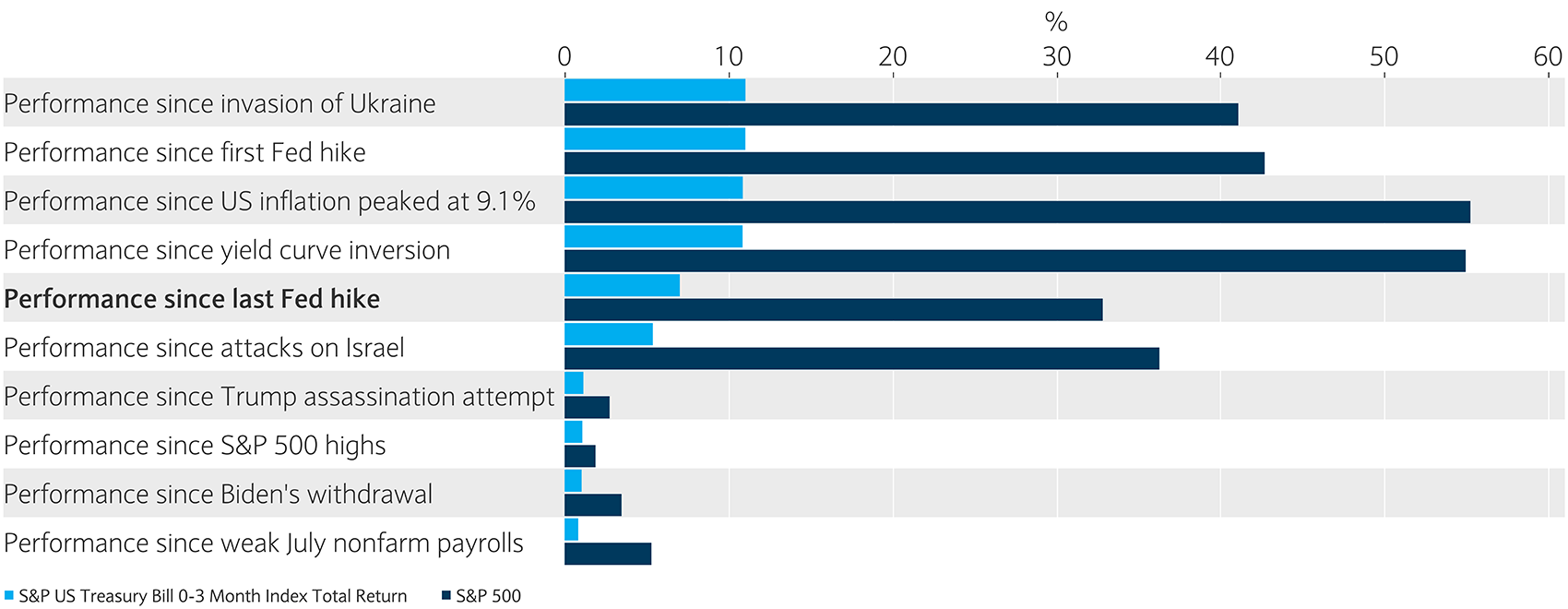

The next chart shows the historical US treasury 3-month money market yield, and the relatively short window available to obtain peak yields. It also shows this return versus the return from US equities, since recent market events.

Despite the elevated cash returns, the table illustrates that holding cash has been a losing proposition when compared against US equities. Indeed, since the last Fed hike in July 2023, cash has returned 7.0% while US equities returned over 4.5-times that, at 32.8%.

The compensation for being invested

The chart shows historical cash rates, and the table shows S&P 500 and cash performance following recent market events

Sources: Bloomberg, Barclays Private Bank, September 2024

Sources: Bloomberg, Barclays Private Bank, September 2024

While past performance is no guarantee of future performance, history shows us that the wheels of growth typically keep turning over time. This long-term trend serves to make the point that holding cash is typically a losing proposition when compared to holding an investment portfolio, for a long-term investor seeking to protect and grow their wealth over time.

Analysis in Barclays Investment Bank’s 2024 Equity Gilt Study shows that for UK equities, over the last 130 or so years, the probability of equities performing cash on any two-year basis was 70%, and this figure rose to 91% over 10 years.

The wheels keep turning

The US economy has been more resilient than was expected coming into the year. In addition, it is ultimately the state of the economy which matters more than the easing cycle when it comes to equity market performance.

This is also true for many of the headlines which are a cause for concern for investors. The fact that they can be front-page news and be a significant focus of market commentary does not necessarily mean that they will have meaningful consequences for an investor’s individual portfolio. It is especially true for long-term investors holding well-diversified portfolios, which are built to withstand and grow through the shorter-term gyrations of markets.

The reality is that behind the headlines, companies continue each day to produce the products and services that generate value for their shareholders and the economy, and it is these companies which make up one’s investment portfolio. It is common to talk about ‘the market’, but it is important for investors to distinguish their own individual portfolio from it.

The growth of companies, economies and markets go on, sometimes in the background, slowly and steadily growing the wealth of investors who stay the course, and benefit from the power of compounding. While current events can and will impact the market, attempting to pre-empt, and wait for them to materialise before taking investment decisions, can enhance returns for those who get calls right. History shows that those who look beyond the headlines and put and keep their money to work throughout the ups and downs of markets, have been well-compensated for their actions.

Related articles

Disclaimer

This communication is general in nature and provided for information/educational purposes only. It does not take into account any specific investment objectives, the financial situation or particular needs of any particular person. It not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful, nor is it aimed at any person or entity to whom it would be unlawful for them to access.

This communication has been prepared by Barclays Private Bank (Barclays) and references to Barclays includes any entity within the Barclays group of companies.

This communication:

(i) is not research nor a product of the Barclays Research department. Any views expressed in these materials may differ from those of the Barclays Research department. All opinions and estimates are given as of the date of the materials and are subject to change. Barclays is not obliged to inform recipients of these materials of any change to such opinions or estimates;

(ii) is not an offer, an invitation or a recommendation to enter into any product or service and does not constitute a solicitation to buy or sell securities, investment advice or a personal recommendation;

(iii) is confidential and no part may be reproduced, distributed or transmitted without the prior written permission of Barclays; and

(iv) has not been reviewed or approved by any regulatory authority.

Any past or simulated past performance including back-testing, modelling or scenario analysis, or future projections contained in this communication is no indication as to future performance. No representation is made as to the accuracy of the assumptions made in this communication, or completeness of, any modelling, scenario analysis or back-testing. The value of any investment may also fluctuate as a result of market changes.

Where information in this communication has been obtained from third party sources, we believe those sources to be reliable but we do not guarantee the information’s accuracy and you should note that it may be incomplete or condensed.

Neither Barclays nor any of its directors, officers, employees, representatives or agents, accepts any liability whatsoever for any direct, indirect or consequential losses (in contract, tort or otherwise) arising from the use of this communication or its contents or reliance on the information contained herein, except to the extent this would be prohibited by law or regulation.