Why Omicron, volatility or inflation shouldn’t knock you off your investing journey

04 January 2022

4 minute read

As the last few weeks have shown with the emergence of the new Omicron variant, there are likely to be more challenges ahead for investors to navigate as we enter the new year.

But it’s worth noting that risks on the horizon should not deter people from being invested. There is rarely a perfect time to invest, and there will always be risks.

In the article below, we examine the behavioural considerations that may help investors stay on course to reach their goals, even if the journey becomes turbulent.

Start with your goals

First, you need to be clear on your investment goals – and what you’re trying to achieve.

Investors should have a lens through which to consume investment views, and can consider how to capitalise on opportunities, or mitigate risks that may jeopardise their goals. For instance, our investment experts examine the macroeconomic outlook and asset classes in fine detail before acting on it.

Additionally, those that are clear about their goals may be better able to manage volatile periods by having a longer-term perspective. Those chasing performance for performance’s sake may be more susceptible to behavioural biases due to a more myopic approach.

Check your confirmation bias

It's good practice when reading financial news to pay attention to, and actively seek out, views which are different from your own – to minimise the likelihood and impact of nasty surprises.

Humans tend to seek out or pay more attention to information which confirms their prior beliefs – the confirmation bias – which can lead to biased decision-making.

And in difficult markets, the risk of biases in decision-making can be elevated, according to a recent survey by Cerulli Associates1 – who found a marked increase in observed biases in investors navigating financial markets during the pandemic.

Challenge your thinking

A vital aspect of robust decision-making is to challenge one’s thinking. This is particularly true when forming an investment outlook; biased thinking may have repercussions in the form of short-term tactical positioning which drags on returns.

In addition, biases can affect asset allocations, which may be more significant for an investor’s return profile over the long term. This may, for example, cause an overweighting to an asset class or sector due to a long-held view – which may have been correct in the past, but is no longer the case today, and to which an investor gives insufficient weight.

A good way to challenge your thinking is to consider what the impact would be if your views were wrong. Where the impact may be material, appropriate hedging may be advisable – as well as diversification – which we come on to later.

Thinking about the impact on your individual portfolio

But what if some of these risks materialise? What should investors do when events occur that have possible implications on their portfolios?

Investors should remember the primary risk to be concerned about is not achieving their goals. Look at whether events materially affect your ability to reach these goals, and if so how.

If, for instance, inflation persists and central banks move more quickly in raising rates – it is likely to be worse for growth relative to value stocks, because cash flows of the former are further into the future. As such, when cash flows are discounted at a higher rate, these companies become relatively less valuable.

But at a portfolio level, the impact is not as clear cut and may not mean that an investor holding growth companies would see the value of their portfolio drastically depressed.

Rising inflation can affect different companies in very different ways. It could typically result in higher raw material, wage and debt servicing costs. Companies that can minimise these costs, while passing them on to consumers, will do better than companies that do not.

Therefore, in our example, companies with higher pricing power may be affected less, even if they fall under a style which inflation is typically bad for.

Avoiding acting too quickly without consideration

If we continue our example above, rotating from growth to value might hurt an investor in the short term – but this may reverse as times goes on.

Favouring particular investments in response to an event, such as a rate rise that may be beneficial in the short term, these investments may then soon fall out of favour if economic conditions change.

On the other hand, a quality company with a strong fundamental business case and strong pricing power may be expected to continue to grow and provide a good return for an investor over the long term, regardless of any macro environment.

A bottom-up stock picker picks companies based on the strength of those businesses, and not macro factors. So, a knee-jerk reaction to sell those companies in response to a rate hike may not be the best decision in the long term. In the short term, of course, it could temper possible underperformance, but when taking a broader view an investor may have sold a very good business that is still expected to perform in the long term. Remember, businesses don’t necessarily stop being good businesses just because of higher interest rates.

The lesson here is that not all news has to be binary good or bad – and an investor’s individual portfolio is not the market. A tried and tested way to minimise the impact of any one event on an investor’s portfolio is to have a portfolio which is well diversified, which we come on to now.

Diversification is the best protection

A diversified portfolio remains the best way to protect and grow your wealth across all market conditions, due to imperfect correlations between assets, which can reduce risk and smooth returns.

Diversification involves owning a range of securities within different asset classes, which are unlikely to respond to market developments in the same way. It can also be used to hedge for specific risks.

When we consider risks to a portfolio, we cannot discount unknown unknowns – risks that we don’t know that we don’t know. A global pandemic, for example, is an event that most investors didn’t consider as a risk factor.

Given the unexpected nature and consequences of such events, one way to reduce the possible impact is to hold a variety of asset classes – such as equities and bonds, cash, infrastructure assets, private equity and debt, and real estate.

On any given year, it’s almost impossible to predict the ranking of returns across asset classes, and so holding a range of assets may be a good approach. By diversifying, top-performing investments may help compensate for underperformers.

Having an emotional buffer

Diversification can also provide an emotional buffer. A key insight from behavioural finance is that losses, and the prospect of losses, can have an outsized impact on your decision-making. In addition, our natural aversion to losses can induce us to make decisions to stem losses in the short term which may not be in our long-term interest.

An example of this is selling at the bottom of a downturn or cutting our risk exposure, despite being a long-term investor and having sufficient liquidity to see it through. In periods of stress, investor time horizons can feel shortened, possibly increasing the perceived riskiness of investing. Indeed, loss aversion can lead to decisions which provide short-term comfort but put at risk long-term investment success.

This makes volatile periods particularly challenging for investors, where the risk of biased decision-making is high.

Particularly as volatility is the norm in investing

By offering a layer of protection against volatility, diversification can protect you from the emotions that volatility in a portfolio can induce. The benefit is that while others may have their decision-making impaired during a market crisis, holding a diversified portfolio can create the conditions for you to think clearly. Having a clear head is important for taking effective decisions and capitalising on opportunities that may arise while navigating additional risk events.

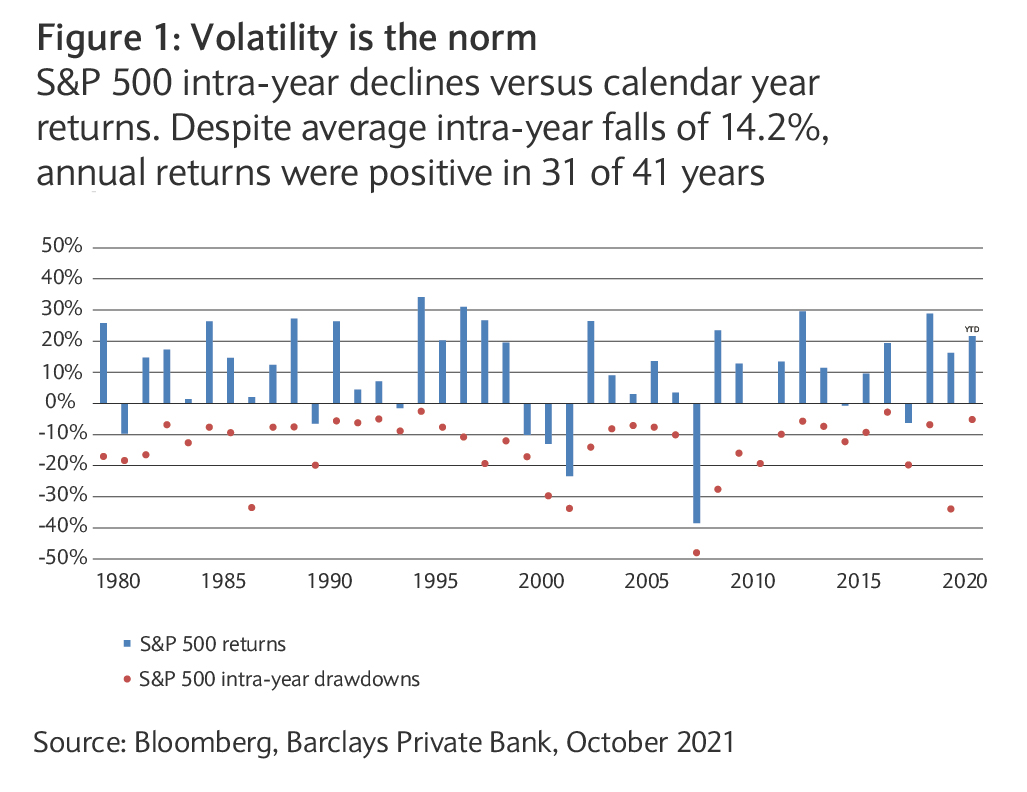

Volatility is also a normal part of investing (see Figure 1) so investors need a plan to ride out these periods instead of just reacting to them – so they can reap the benefits of staying invested.

Active management is key too

While diversification offers important benefits, it is not an investment approach. Just holding a selection of assets and doing nothing more may not maximise an investor’s returns for the level of risk they are taking.

Active management of an investment portfolio, with robust investment processes designed to produce investor value over the long term, may be able to generate additional returns for the same or a lower level of risk – and active managers can outperform benchmarks due to factors such as asset class allocation, security selection or a style bias.

Is now a good time to invest?

Given the investment opportunities and risks at play right now – and that volatility is the norm – investors will ask is now a good time to invest in financial markets?

As we know, COVID-19 is one such risk and continues to have the power to send shockwaves through the global economy. Nevertheless, as we look to emerge from this difficult period, we still anticipate above-trend global growth of 4.5% in 2022 as the expected recovery phase plays out.

And while having strategies in place to deal with turbulence is helpful, we understand that investing and staying invested at a time where there are possible risks on the horizon can be unsettling for some.

Volatility on the journey also does not necessarily prevent you from reaching the destination. As Figure 1 above illustrates, the S&P 500 has posted positive annual returns in 31 of the past 41 years – averaging 10.3% – despite average intra-year falls of 14.2%.

Compare this to holding cash. The returns of the S&P 500 far exceed what you may get from holding cash; we expect the average real cash return of close to -1% over the next five years.

So, as history shows, getting and staying invested for the long term provides an investor with the best foundations to protect and grow their wealth.