Which accounts?

You can use your app to pay cheques into any Barclays sterling current or savings accounts. However, ISA and Bond accounts, or accounts from other banks aren’t included.

Without having to visit your local branch

We know getting to a branch in opening hours can sometimes be difficult. That’s why we’ve created an easier way to pay in your cheques using your smartphone and the Barclays app – saving you a trip to the bank.

Open the ‘Pay in a cheque’ feature within the Barclays app1. Enter the payee details and amount, then take a photo of your cheque.

The money will typically arrive in your account by 23:59 the next working day2 (if your cheque was paid in before 15:59 on a working day) so you don’t need to wait days to access your money.

You can use your app to pay cheques into any Barclays sterling current or savings accounts. However, ISA and Bond accounts, or accounts from other banks aren’t included.

Cheques worth up to £1000 each can be cashed in using your app. You can pay in four cheques every seven days if you’re a Personal or Premier customer.

This service is equally as safe as paying in cheques at your local branch.

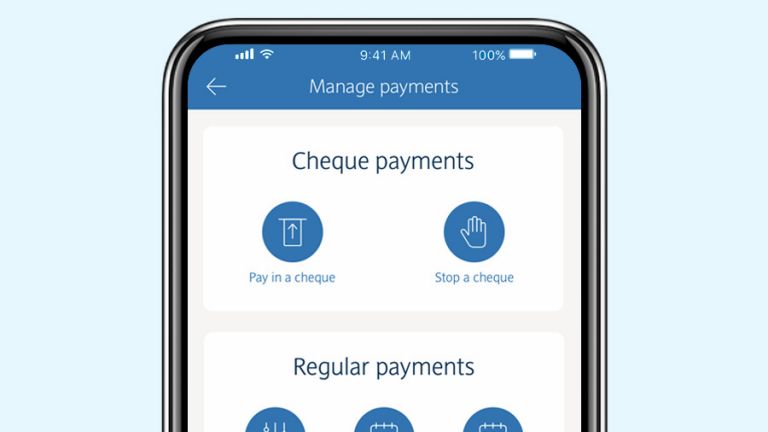

Sign in to your Barclays app and click ‘Pay & Transfer’, then select ‘Pay in a cheque’.

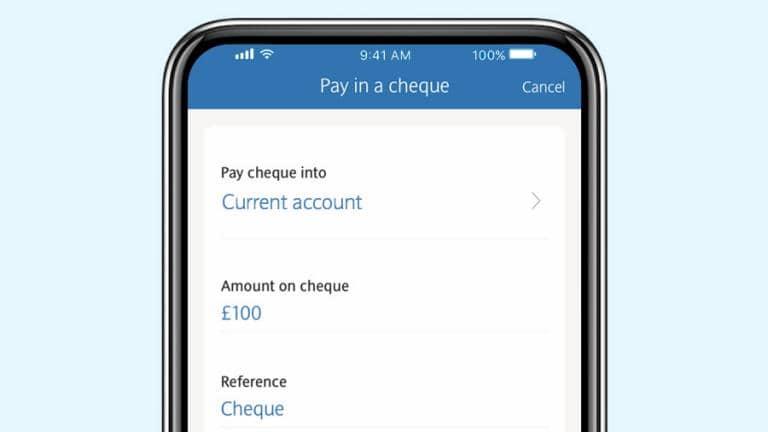

Select the account you would like to pay your cheque into. Type in the value of the cheque and a reference if you need one, then click ‘Take photo’.

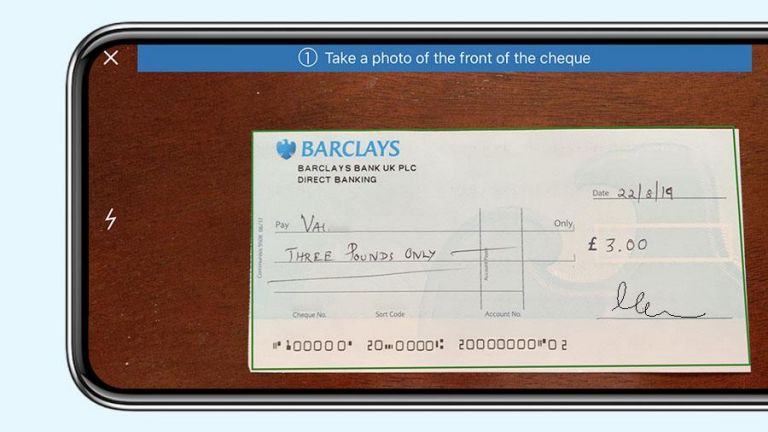

Position the phone’s camera over the front of the cheque. A frame on the screen frame will turn green when the cheque is in the right position. It will then take a picture automatically. Repeat this on the other side of the cheque too.

Check the image to make sure it’s in focus and includes the whole cheque. Once happy, tap ‘Use image’.

Review the details and if all correct tap ‘Pay in cheque’ and it’s all done.

If the cheque is cashed in before 15:59 on a working day (Monday to Friday, except bank holidays), it’ll clear by 23:59 the next working day. It will appear in your account almost instantly, but the money won’t be available until the cheque has cleared and appears in your available balance.

Yes, we accept most cheques from UK banks, although some issuing banks don’t allow you to clear cheques using a photo yet. If you try and pay in a cheque from one of those banks, you’ll get a message telling you to take the cheque to a branch to pay it in.

You can use your app to pay in four cheques every seven days into a personal account.

We may change these limits at any time. If you need to pay in more cheques than the above amounts, please go to your local branch.

The day you pay your first cheque in via the app. The count is reset every seven days following that day.

The cheque may still have gone through. Check by clicking on ‘View cheques paid in’. if you’re cheque is listed there, it’s gone through. If not, try paying it in again when you have better reception.

You can’t pay in the same cheque twice, so you don’t need to worry about that. If you try to, we’ll notify you.

Your camera may not have captured all of the information we need. Take another photo and make sure that:

Some smartphone cases interfere with the camera, so removing the phone from the case can make photographing your cheque easier.

If you've tried this and the problem continues, please pay in your cheque at a branch.

Yes, there are. You can only pay in cheques for up to £1000.

You have to be registered for the app and use most updated version of it. You can only pay pound sterling cheques into a Barclays sterling account.

At the moment, we don’t support every sort code. If the sort code on your cheque isn’t supported, we’ll tell you when you try to pay it in.

There’s a weekly limit of four cheques per week that you can pay into a personal account using your app.

We’ll let you know what to do if you find you can’t process your cheque using your phone. You can also get in touch with us by clicking on the ‘Call us' icon in your app.

We recommend you to write 'paid in' on the back of your cheque and then keep it for at least ten days, just in case we need to contact you about it.

Check your balance, make payments and keep on top of your finances with our app.